Moody’s as an inflation hedge (NYSE:MCO)

Chunumunu/iStock via Getty Images

The best rating company Moody’s (NYSE: MCO) should benefit from an inflationary environment.

Two things are key to protecting income as the prices of everything rise:

- First, unsurprisingly, there is a good degree of pricing power. The rare ability raising prices without losing volume offsets higher costs with increased revenue.

- Second, a low capital expenditure requirement. The prices of fixed assets increase stealthily during inflation. Depreciation charges are based on historical acquisition costs and therefore understate actual replacement costs in the presence of inflation. When the time comes to purchase that new piece of equipment, the truth is suddenly revealed and revenue is hit.

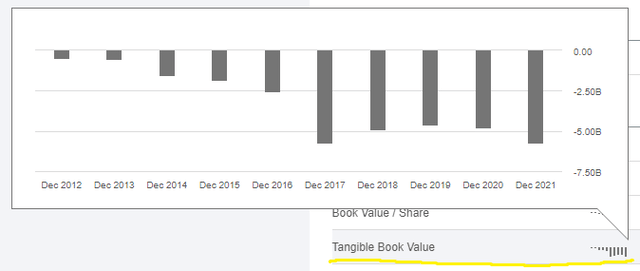

Moody‘s, a service business, has a negligible need for capex and can grow without consuming capital in other ways (like working capital). For proof, look no further than the tangible equity of the last ten years. Despite revenue growing from less than $3 billion to over $6 billion – and earnings doubling twice during this period – tangible book value has been negative by around -$5 billion since then. 2017.

Tangible BV at the end of the year (Seeking Alpha)

The moat around it

In my opinion, Moody‘s and its counterpart S&P Global Inc. (SPGI) have some of the strongest moats in the market. Several aspects of their competitive advantage have proven to be enduring. Understanding them to assess their future resilience is really our main job as value investors. Here are some of these aspects:

Industry structure

The industry has coalesced around three providers (Fitch Ratings Inc., privately owned by Hearst Corporation) in addition to the two just mentioned. Nine rating agencies are recognized by the SEC as “nationally recognized” (NRSRO), only three have achieved global scale. There is a similar effect in the market for large audit jobs, with virtually all public companies hiring one of the “big four” for their annual audit opinion. In the case of auditors, these four brands – EY, Deloitte, KPMG and PWC are recognized as being roughly interchangeable in terms of quality of professional service. Unlike financial statement audits, where one opinion suffices, companies typically request two or three credit rating assessments, as typically required by investor/buyer mandates.

Track record and barriers to entry

In theory, anyone with access to Excel and a decent business background could potentially start a credit scoring service. The very high barrier to entry that actually exists is driven by two factors. First, the value of a rating opinion (to the buyer of a debt security) comes from the “evidence” that it has worked in the past. Specifically, the actual frequency of observed defaults as predicted by the original rating assessments over a ten or twenty year window. To get there, you have to score a very large population of issuers and then wait for the actual results to come in. It is very expensive and eventual success, if any, is only possible after a few decades of investment. You canYou can’t make a baby in a month by getting nine women pregnant, nor can you create a 20-year track record any faster.

Value proposition and network effect

A deep value proposition is a key part of most flukes. Providing far more value than the price of your widget is actually the fuel that fuels customer goodwill, brand, and moat expansion.

Like all good networks, there is a winner on both sides. Debt buyers benefit from the immediate comparison of rated notes with all alternatives available at that time with a similar rating. This results in greater liquidity of rated notes compared to unrated debt.

Sellers, for their efforts, get a reduced interest/coupon rate. Rating, in effect, opens the door to the vast pool of investable capital that is otherwise limited to investing in unrated papers. This buy-side restriction is hard-coded into the investment policy guidelines of virtually all grantees, with language such as “rated investment grade by at least two of the three major credit rating agencies…”

So, buy-side value comes from the significant time saved by relying on third-party reviews rather than performing in-house credit analyses. This is extremely important for large institutional investors who, being directed by agents (boards of directors, trustees, etc.), can indeed use the ratings both to define the orientations of the investment policy and also, indirectly, to get rid of some of the responsibility for investment decisions. The result is a complete standardization of credit risk assessment language (single/double/triple A, B, +/- etc.) so ingrained in the bond markets that it seems impossible to imagine a world without them. .

On the sell side, Moody’s estimates that a rating on a typical issuer saves 40 basis points on the coupon rate compared to an equivalent unrated issue. For a “benchmark” issue of $500 million, this equates to $20 million, or $2 million over 10 years, in avoided interest costs. In exchange, Moody’s standard rating fee is typically 7 or 8 basis points, representing a fraction of the savings and legal and transaction structuring costs. The huge gap between delivered value and price is what fuels the fluke and allows pricing power to persist.

So choose your preferred source of competitive advantage. Irreplicable track record, network/scale effect, high barriers to entry, low cost/value ratio, premium brand, etc. There are elements of everything and borders intertwine.

How inflation flows through the income statement

First, the bad news. A major component of Moody’s costs is labor and these will increase for Moody’s and for every business. The real question is whether this impact can be more than offset by higher revenues and, therefore, defend (or even increase) operating leverage.

Revenues are a function of volume and price. Let’s leave the pricing power aside for now. On the volume side, global debt issuance is driven by global GDP growth. It is important to note that it is driven by nominal GDP growth and not by real GDP growth. The nominal is more real in this case.

Unless inflation spirals out of control and begins to drive down real growth, companies will experience higher revenues, higher costs, higher EBITDA and therefore higher debt issuance to maintain a structure. of constant capital (of, say, 3x EBITDA). Similarly, a sovereign issuer will incur higher taxes and strive to maintain a target debt-to-GDP ratio on a nominal basis.

A company that does all of this may have gotten nothing for its investors other than to grow its profits at the rate of inflation. A government would have simply decided to increase debt servicing costs to match inflated tax revenues. Essentially, the stock of debt has to grow at the rate of inflation to keep everything the same. Because credit reporting agencies have a toll booth on the road to issuing debt, they directly benefit from increasing debt balances.

Importantly, this increase in revenue does not involve onboarding a single new customer. No customer acquisition costs, due diligence, no new employees hired, no travel. Hence, the operating leverage improves without any effort from the company.

Add to that the 3% pricing power that we set aside earlier – and which the CEO noted “remains intact” in the recent earnings call – and you have revenue growth again with no structural change. costs.

As it stands, inflation of 7%, global real GDP growth of 3%, and pricing power of 1% (the 3% shown above is about 1% higher than the actual inflation) imply additional revenue of 11% (the company’s forecast is 10%). For a company with strong operating margins, which exceed 50% for Moody’s, and given further growth in its non-rating business (which is also growing rapidly), EPS could grow by more than 15% during of the next few years. Continued share buybacks will further contribute to earnings per share growth.

Evaluation

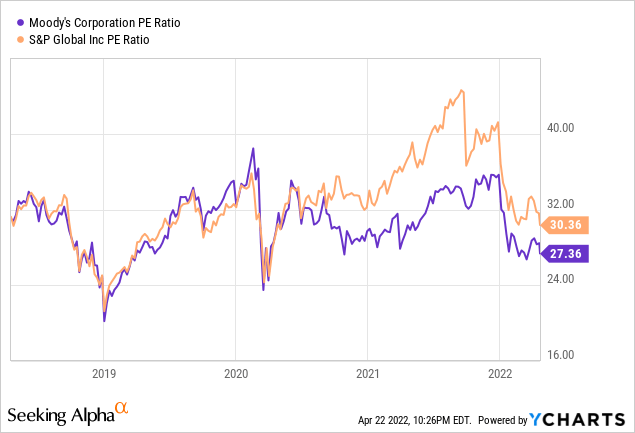

Evaluation, I contend, is not stretched at MCO. As for the historical multiples of the PE, it is close to the level reached at the end of 2018 (Fed tightening + trade wars) and Q1 2020, the lows of the containment.

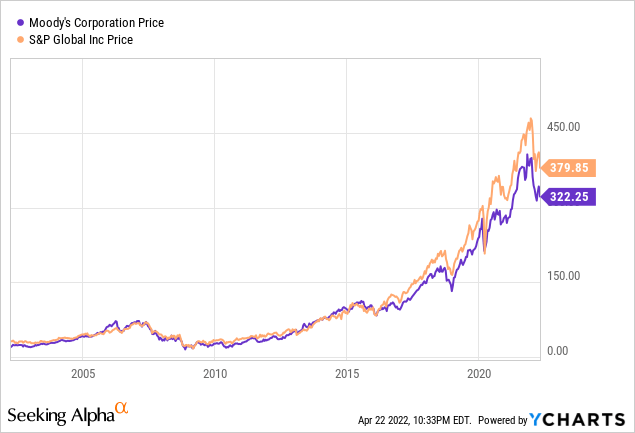

Going back 20 years, to make sure we include the rise and fall around the GFC/subprime debacle, the price chart looks like this:

Over the past 10 years, revenue has quadrupled from about $3 to $12, which is a CAGR of 15%. This is what the preparers do for you. I’m including S&P to show how well these companies track each other (I own both); and to note a slight relative advantage on the MCO valuation for the moment.

Risks

Regulatory risks are still hovering in the background. S&P Global and Moody’s settled all GFC litigation a few years ago, unblocking their share buyback programs. The usual regulatory complaints relate to concentration and perceived market power. In my view, the best defense is for Moody’s to continue to provide value far beyond what it charges customers, which very likely invalidates merit-based arguments.

The risks posed by inflation itself are more systemic than company specific. If inflation spirals out of control and begins to dampen economic growth, all stocks will suffer. This is the risk the Fed is trying to avoid, hoping to engineer a “soft landing” for the economy by raising rates and bringing inflation under control.

In the short term, debt issuance volumes will be chaotic. This is natural during cycles of tightening (and geopolitical risks). Management has already noted a decline in high yield issuance in the first quarter. Nevertheless, the debt issued must be refinanced at some point.

Conclusion

We have not faced persistent inflation for the past 40 years. It is a risk where there is not much to do because a lot has changed structurally since the last experience. Faced with this lack of reference, turning to basic principles makes sense: look for small capitalization companies with pricing power. Good to own anytime, but especially during times of inflation. If these can be purchased at reasonable prices, even better. Moody’s seems to tick all the boxes right now.

Comments are closed.