LQD: Investment Grade Corporate Bond Index ETF, 2.4% Low Yield, High Rate Risk (LQD)

mattjeacock/iStock via Getty Images

Author’s Note: This article was released to members of the CEF/ETF Income Laboratory on January 30, 2022.

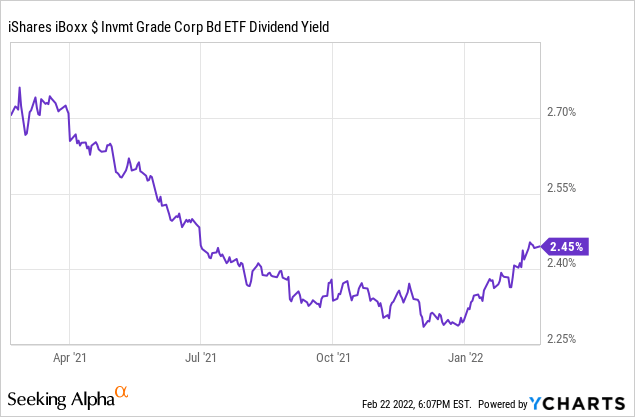

The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) is a broad-based investment grade corporate bond index ETF. LQD’s holdings are fairly good quality and the fund tends to do reasonably well during downturns and recessions. On the other hand, the fund offers investors a paltry 2.4% dividend yield and, with a duration of 9.2 years, should suffer significant losses if rates were to rise, which seems likely. LQD is a high risk, low return investment opportunity, and therefore I would not invest in the fund at this time.

The basics of LQD

Presentation and analysis of LQD

LQD is the largest investment grade corporate bond index fund on the market, acting as an industry benchmark. The fund is administered by BlackRock, the world’s largest investment manager.

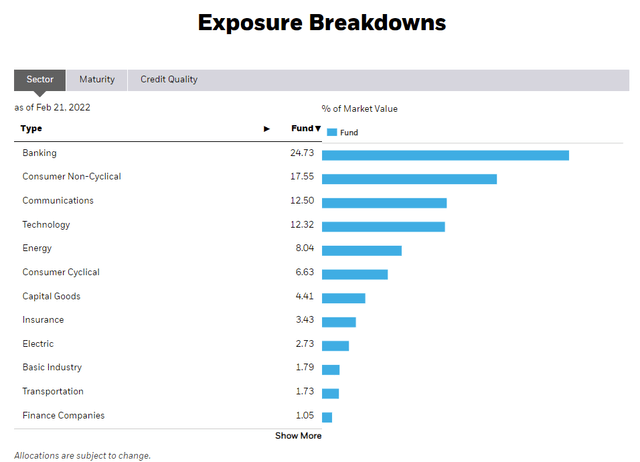

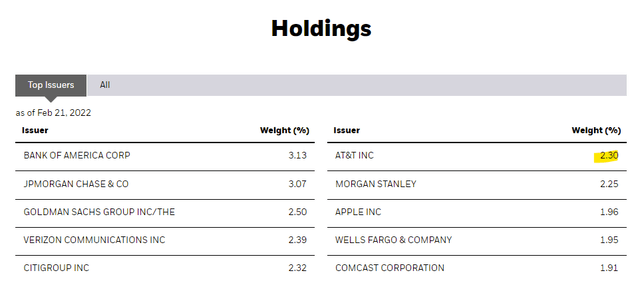

LQD tracks the Markit iBoxx USD Liquid Investment Grade Index, a broad index of high quality corporate bonds. It is a relatively simple index, comprising all dollar-denominated corporate bonds from issuers in developed countries with investment-grade credit ratings (BBB or higher). Relevant securities must also meet a basic set of liquidity, size and trading criteria. It is a market capitalization weighted index with a 3% issuer cap.

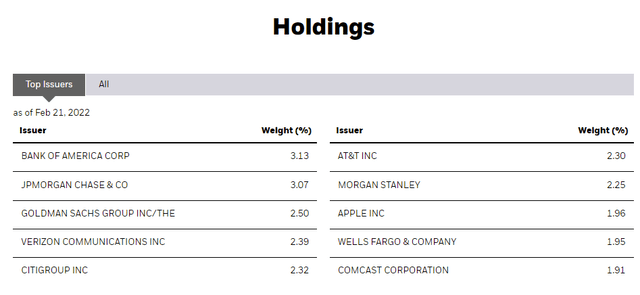

LQD is a well-diversified fund, with investments in 2,494 different bonds and exposure to the most relevant industry segments. Concentration is also fairly low, with the fund’s top ten issues accounting for just 22% of the fund’s value. Diversification reduces risk and volatility, and effectively prevents the possibility of large losses or underperformance in the event of a company’s bankruptcy or default.

LQD Corporate Site

LQD Corporate Site

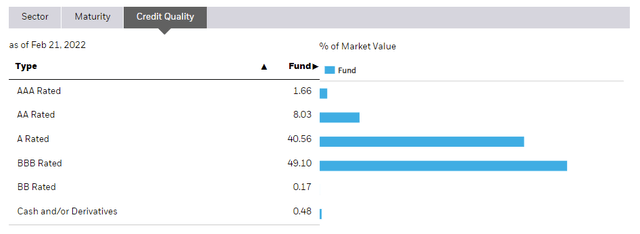

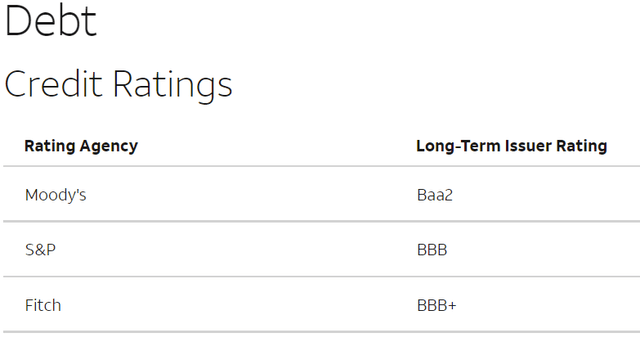

LQD focuses on higher quality corporate bonds, with a median credit rating of BBB. This is a reasonably good rating, indicating reasonably strong companies with good balance sheets and financial statements. Both risk and default rates are quite low. The credit ratings are as follows.

LQD Corporate Site

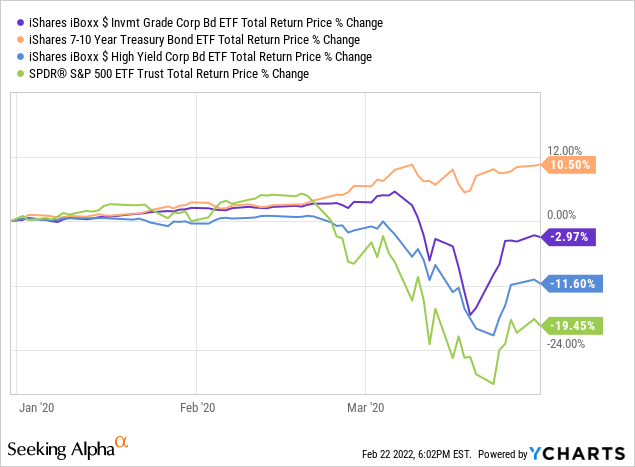

LQD’s holdings are reasonably safe, which should lead to reasonably strong performance even in difficult economic conditions. Expect relatively small losses during downturns and recessions, somewhere between those of Treasuries, the safest fixed-income securities, and high-yield corporate bonds, the riskiest. This was the case in the first quarter of 2020, at the start of the coronavirus pandemic and the most recent downturn.

In summary, LQD offers investors diversified exposure to higher quality corporate bonds, which are relatively safe securities. Although the fund appears to be a reasonable investment opportunity for more risk-averse investors and retirees, it suffers from two serious flaws. Let’s take a look at these.

LQD – Negatives – Below average yield, above average interest rate risk

LQD currently boasts a paltry 2.4% dividend yield, combined with an excessively high duration of 9.2 years. The income and potential returns are quite low, while the interest rate risk is quite high, a dreadful combination. Before taking a closer look at these two measures, I want to explain How? ‘Or’ What they came about because I think it will help us understand the issues facing the fund.

Take AT&T (T), the fund’s sixth-largest issuer, as an example.

LQD Corporate Site

AT&T is one of the largest telecommunications companies in the United States, with multiple lines of business, tens of millions of customers in dozens of customers, and a growing subscriber base. It is also one of the most indebted companies in the country, with over $150 billion in net debt. Debt is high given the company’s finances and assets, with a debt to EBITDA ratio of 3.7x and a debt to equity ratio of 1.0x. These are not great numbers, although they could be worse.

AT&T is also a reasonably safe and sound company, with adequate capacity to meet its financial obligations because, well, because the credit rating companies say so and have rated the company’s debt as BBB.

AT&T Corporate Website

Notwithstanding the foregoing, AT&T’s enormous indebtedness and resulting interest charges have been a continuing risk and negative for the company and its shareholders. Debt is costly and must be repaid in full when due. Money spent on servicing and paying off debt is money that is not being used to invest in the business, jeopardizing the growth and future of the business. Excessive debt is bad, and AT&T is excessively indebted.

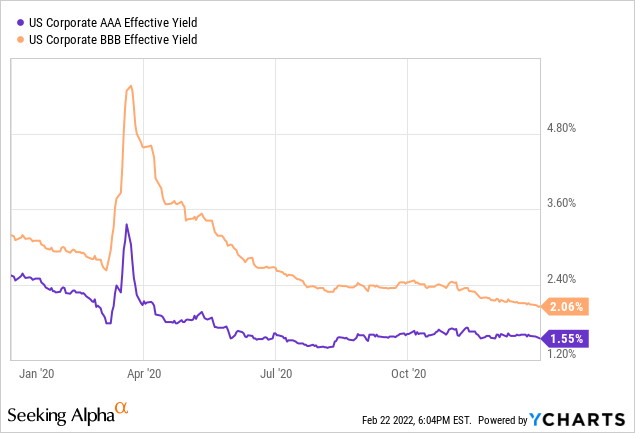

Then came the pandemic and the resulting political response. The Federal Reserve cut rates to zero and embarked on a massive program of quantitative easing. These have focused on corporate bond purchases, including the direct purchase of LQD. Interest rates have fallen, particularly for securities that have been subject to direct intervention by the Federal Reserve, including investment grade corporate bonds.

AT&T took advantage of the above, refinancing about half of its total debt on more favorable terms in 2020-21. Interest rates have fallen, maturities have increased. The company effectively locked in the lowest interest rates in a generation for its massive indebtedness to decades. Investors agreed because, well, what choice did they have. Treasury bills had even lower yields, as did other low-risk assets like CDs, money market funds, etc. High-risk assets had higher returns and potential returns, but the risks were also significantly higher and economic conditions were still uncertain. High-quality corporate long-term debt made sense, especially given the implicit Federal Reserve backstop.

LQD itself holds about $760 million in AT&T debt, and the terms are pretty good for AT&T. Most of the debt was issued after 2020 and therefore benefits from the above. The debt carries an average coupon of 3.8%, with an average maturity of 18 years. The terms are favorable to A&T, less favorable to LQD or its shareholders, but that was the best the market offered at the time.

By the end of 2020, the Federal Reserve had suspended its purchases of investment grade corporate bonds. In mid-2021, he was selling his holdings. At the end of 2021, it signaled impending rate hikes. Suddenly lending money to AT&T at 3.8% for 18 years seemed unattractive. Investors sold AT&T debt. Bond prices fell about 8.0%, according to LQD filings. Capital losses have exceeded coupon rate payments, and so investors, including LQD, are underwater in their investing, so far at least.

LQD is now stuck with hundreds of millions of low-yielding, underperforming AT&T bonds. Expected returns are quite low, as bonds yield only 3.8%. The risks are high, as bonds would suffer further capital losses if interest rates were to rise. LQD is stuck with these bonds for about 18 years old, a very long time. If you invest in LQD, you will also be stuck with these bonds, and although you can always sell your investment in LQD, you may be forced to sell at a loss if interest rates continue to rise. In my opinion, this is obviously an incredibly negative situation, and therefore I would not invest in LQD at this time.

Going back to the metrics, LQD offers investors a paltry 2.4% dividend yield and an excessively high duration of 9.2 years. The fund’s dividend yield is quite low in absolute terms and the lowest yield in the fund’s history. LQD offers investors little income or potential returns, a significant negative for the fund and its investors. As explained with AT&T, the fund’s low dividend yield is the result of Federal Reserve policy. The fund could be a buy once the policy changes, but that hasn’t happened yet.

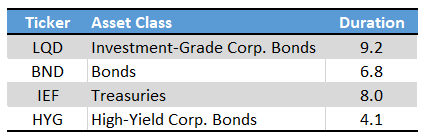

LQD also sports a duration of 9.2 years. Duration is a measure of interest rate sensitivity and risk. A 1% rise in interest rates should lead to 9.2% capital losses, and vice versa. LQD has a higher duration than most of its peers, largely because companies have taken advantage of historically low interest rates to issue long-term debt securities at favorable rates. LQD’s duration is moderately longer than most of its peers.

Company Filings – Table by Author

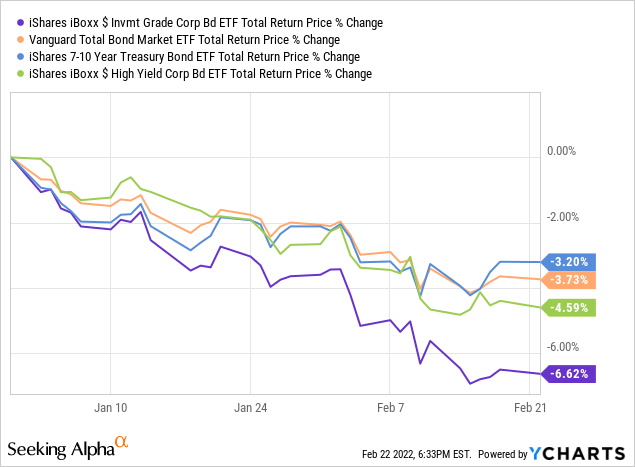

LQD’s above-average duration should cause the fund to underperform its peers when rates rise, as it has since the start of the year.

LQD’s above-average duration increases risk, and is particularly detrimental when interest rates rise, as is currently the case. In my opinion, in the current circumstances, investors should avoid excessive duration funds, which means avoiding LQD.

Conclusion

LQD is a high quality corporate bond index ETF. LQD offers investors a paltry 2.4% dividend yield and could suffer significant losses if interest rates continue to rise. LQD is a high risk, low return investment opportunity, so I would not invest in the fund at this time.

Comments are closed.