“Government measures helped limit G-Sec’s return despite rising repos”

Easing inflation on lower crude oil prices also helped, BoB report says

The yield on the benchmark 10-year government security (G-Sec) rose only 32 basis points vis à vis the 90 basis point hike in the key repo rate since the start of the current rate hike cycle on May 4.

For the United States, in the current cycle of rate hikes, which started from March, the federal funds rate was raised by 150 basis points while the yield on its 10-year paper rose by 77 basis points over the same period, according to the Bank of Baroda economic report. research report.

Supply side measures

Referring to the recent moderation in domestic yields from rising repo rates, Dipanwita Mazumdar, Economist, BoB, observed that domestic yields were being comforted by government measures on the supply side (tariff cuts excises on gasoline, diesel and edible oil price measures) to check inflation. The current reading of inflation in June was also slightly comforted by these measures.

She noted that oil prices have fallen 11.9% in the current fortnight (ending July 15) and 18.1% from their peak of $124 a barrel reached on June 8, 2022. This comforted domestic returns on the expectation of less inflationary burden.

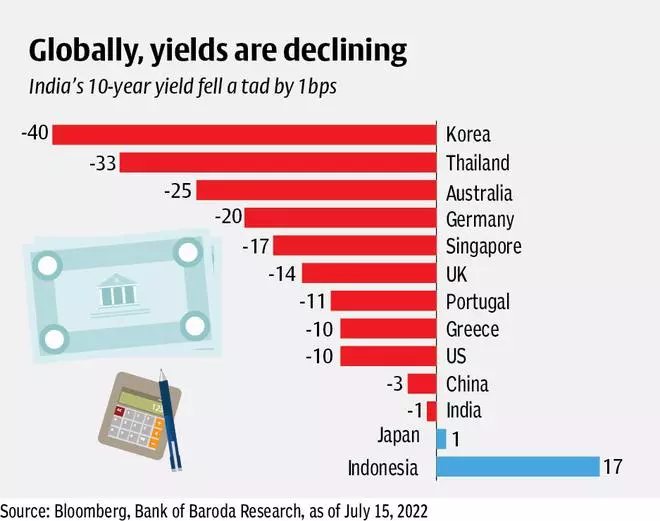

“Global 10-year sovereign yields showed moderation across the board, with recession fears outweighing inflationary concerns. However, central banks kept price stability in mind and continued to hike. aggressive rates.

“India’s 10-year yield has declined only a little in the current fortnight,” Mazumdar said.

The yield on the benchmark 10-year G-Sec (coupon rate: 6.54%) closed at 7.4381% on July 15 from 7.4241% on July 1.

The Economist pointed out that sustainable liquidity is still at a high level. This supports yields outside of risk aversion sentiment due to heightened growth concerns.

“We expect India’s 10-year yield to trade in a range of 7.40-7.50% over the next fortnight as risks remain on the upside.

“The big event will be the Fed policy meeting. According to the CME Fed watch, 71% of traders expect a rate hike of 75 bps. However, 100 bps cannot be ruled out either. product, domestic yields could rise slightly in line with global yields,” she said, adding that a repo rate hike of 50 to 75 basis points is expected in the current cycle.

Additionally, any auction deconcentration will put pressure on yields, as seen in the July 15 auction. Even currency depreciation also poses an upside risk to the domestic return outlook in terms of REIT debt outflows.

Rupee violates 80

Meanwhile, the rupiah broke above 80 against the dollar for the first time during official trading hours, hitting an intraday low of 80.06 even as the dollar index falls and the euro strengthens. .

However, heavy intervention from the Reserve Bank of India helped the Rupee close down around 3 paise at 79.94 to the dollar against the previous close of 79.97.

Published on

July 19, 2022

Comments are closed.