Government debt yields mixed on auction result, US data

YIELDS on government securities (GS) ended last week on a mixed note after the Treasury fully allocated its 10-year Treasury bond reissue offer and US inflation appears to have peaked .

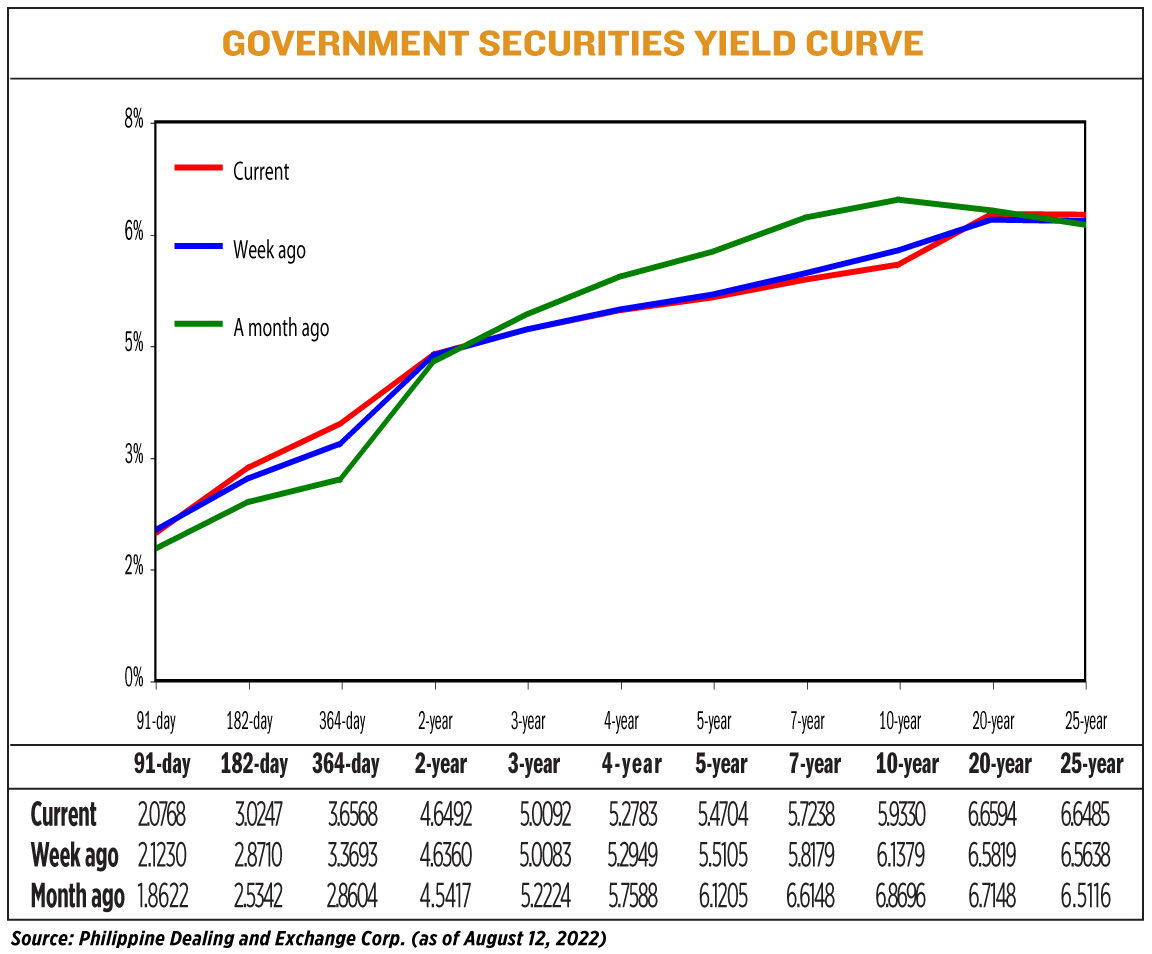

Debt yields, which move opposite to prices, rose 1.96 basis points (bps) on average week over week, based on benchmark rates from the PHP Bloomberg Valuation Service August 12 published on the Philippine Dealing System website.

Yields across the yield curve ended mixed. Yields on 182-day and 364-day Treasury bills (T-bills) rose 15.37 basis points and 28.75 basis points to 3.0247% and 3.6568%, respectively. Meanwhile, 91-day Treasury bills fell 4.62 basis points to 2.0768%.

On the belly, two- and three-year Treasury bills (T-bonds) rose by 1.32 bp (to 4.6492%) and 0.09 bp (5.0092%), respectively.

In contrast, four-, five-, and seven-year Treasury bills fell 1.66 basis points (5.2783%), 4.01 basis points (5.4704%) and 9.41 basis points ( 5.7238%).

The long end of the curve saw 20- and 25-year debt yields rise 7.75 basis points and 8.47 basis points to 6.6594% and 6.6485%, respectively. At the same time, the 10-year paper rate fell 20.49 basis points to 5.9330%.

The total volume of GS traded for the week rose to 8.656 billion pula on Friday from 7.953 billion pula on August 5.

“The move was primarily driven by strong demand for mid to long-term bonds, with signals coming primarily from a largely oversubscribed primary market and relatively light market positioning,” said Jose Miguel B. Liboro. , Head of Local Markets for ATRAM Trust Corp. an email interview.

“Essentially, given that yields remain decent on benchmark 7-10 year maturities, locking yields at current levels is an attractive proposition for investors expecting some normalization of the CPI. (consumer price index) by next year,” Mr. Liboro said.

“Yields ended the week almost unchanged on mixed signals following the upside surprise in US jobs reports and as weaker US inflation reports bolstered market sentiment according to which US inflation may have already peaked in June 2022,” a bond trader said in a separate email. .

“Critical reports from U.S. consumers and producers have recalibrated market expectations for future Federal Reserve rate hikes,” the bond trader said.

The bond trader added that while global markets still expect another 75 basis point rate hike from the US central bank, future rate adjustments could become less aggressive as inflation is expected to rise sharply. decline in the coming months.

The trader said weaker-than-expected Philippine economic output in the second quarter also affected yield movements last week.

The Bureau of the Treasury (BTr) raised 35 billion pesos as expected through its offering of 10-year reissued securities which have a remaining life of six years and five months last week as bids rose to 105 .72 billion pesos, more than triple the amount on the auction block.

The rates granted ranged from 5.7% to 5.874%. This brought the bond’s average yield to 5.791%, 108.4 basis points lower than the 6.875% coupon earned for the series when it first offered on January 8, 2019.

The BTr opened its tap facility to raise an additional 10 billion pesos to meet the high demand.

Meanwhile, the US consumer price index ended flat month-over-month last July, down from 1.3% in June. On an annual basis, inflation increased by 8.5% in July, less quickly than 9.1% in June.

Producer prices also fell last month due to lower energy costs. The producer price index for final demand fell 0.5% last month after rising 1% in June. In the 12 months to July, it rose 9.8% after rising 11.3% in June.

Back home, preliminary data from the Philippine Statistics Authority showed gross domestic product rose 7.4% year-on-year in the second quarter, easing from the downwardly revised impression of 8.2% observed in the first three months of 2022 and the 12.1% expansion observed year on year. earlier.

For this week, the bond trader said yields could rise amid general expectations of a rate hike of at least 25 basis points from the Bangko Sentral ng Pilipinas (BSP) at its meeting on 18 august.

“The market will look to the 10-year reissue and the next BSP meeting to determine the general direction of yields as well as the general shape of the yield curve,” Liboro said.

“If demand from the 10-year primary market continues to be strong, we expect yields to decline further. BSP will likely take a more hawkish stance given the still-high inflation,” he added. While the front end of the curve may adjust higher, the long end will likely continue to be driven by demand from end users looking to lock in yields.” — AMPY

Comments are closed.