BCV: Deep Discount May Present Opportunity (NYSE:BCV)

Kanawat TH

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on October 21, 2022.

Bancroft Fund (NYSE: BCV) is pushing towards its historically deep discount. It trades at a bigger discount than the average of the last decade. Either way, this is a fund that regularly trades at a discount. I suspect the distribution policy of this lower regular quarterly distribution fund with a big year-end to top off their minimum policy is to blame. Investors generally want high distributions all the time, even throughout the year.

In recent years it was starting to get rid of this discount when convertibles were doing well. Some of the convertible bonds that have been issued in recent years have zero or near zero yields. In a rapidly rising rate environment, this means that the bulk of returns should come from appreciation. Now that growth no longer matters to investors, the fund has struggled with collapsing asset prices.

For a longer-term investor, this could still present an opportunity, but it could take some time. Essentially, we are waiting for the Fed to get data that shows it can pivot and stop being aggressive. At this point, the current discount may or may not be available. An added benefit to the fund could be that as these convertible bonds mature, they should receive a par return to be reinvested in higher yielding investments once the portfolio begins to turn around.

Since we last hedged the fund, the discount had fallen from nearly 9% back then to just over 14% today. This is usually a natural occurrence in closed-end funds during times of volatility. As interest rates rise, the costs of leverage used by CEFs may also rise. This may therefore be a reason to reduce a CEF as well.

For BCV, however, they carry 5.375% Series A Cumulative Fixed Rate Preferred Shares (BCV.PA) as leverage. Although this is a high cost of capital, it is fixed, meaning there is no impact from the Fed’s rate hike.

However, this widening discount may explain some of the underperformance between the fund and the broader market since our last update. Of course, the S&P 500 is not a benchmark, but it can help provide context. Heavier allocations to more growth-oriented companies – those that would be able to find buyers over the past couple of years for their growth prospects – are another big driver of the kind of performance we’re seeing.

BCV performance since previous update (Looking for Alpha)

The basics

- Z-score over 1 year: -1.29

- Discount: 14.04%

- Distribution yield: 7.74%

- Expense ratio: 1.16%

- Leverage: 22.04%

- Assets under management: $142.36 million

- Structure: Perpetual

BCV’s investment objectives are “…to provide income and the potential for capital appreciation; objectives which the Fund considers to be relatively equal over the long term.” Their approach is quite simple; they “operate as a closed-end, diversified management investment company and invest primarily in convertible securities…”

With BCV, we must always emphasize the small size of the fund. This can make it harder for large retail investors to take large positions – at least if one is trying to take a large position all at once. The average daily trading volume is approximately 12.5k per day. This would then also mean that the exit door is quite small when trying to exit a position as well.

In addition, the fund’s leverage ratio is now high. This has been a function of the declines we have seen in the fund since the start of the year. However, this is still a rather modest level of leverage, relatively speaking. As we touched on above, this is also fixed rate leverage, so no surprises on leverage costs are coming for this fund.

Performance – Significant Discount

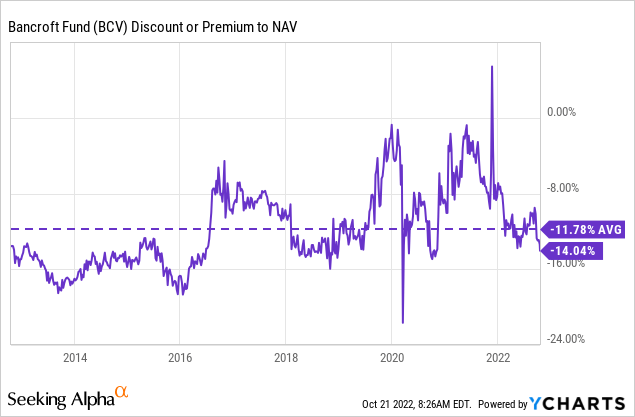

One of the most interesting prospects for this fund, and the main reason to focus on CEFs, is the fund’s discount. At this current level, we are now trading at a deeper average discount than seen over the past decade. Of course, we can see that a 16% discount around 2013 to 2016 was quite widespread. In the COVID Crash, we even see the usual discount spike we’ve seen from so many other funds.

Y-Charts

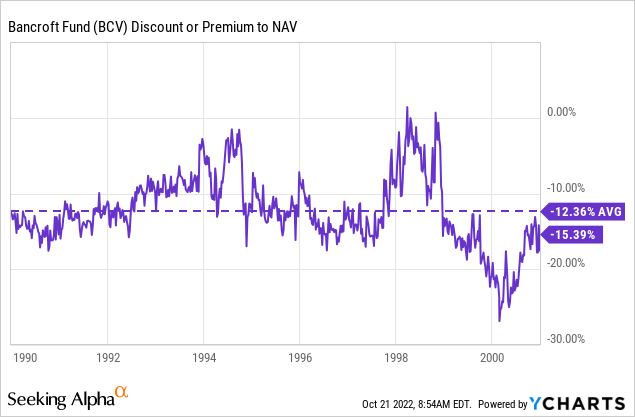

The last decade may not be the most appropriate period, given the new interest rate regime. Luckily, BCV is an old fund, and we can see a bit of history through the 90s and exactly where the average discount was at that time.

Y-Charts

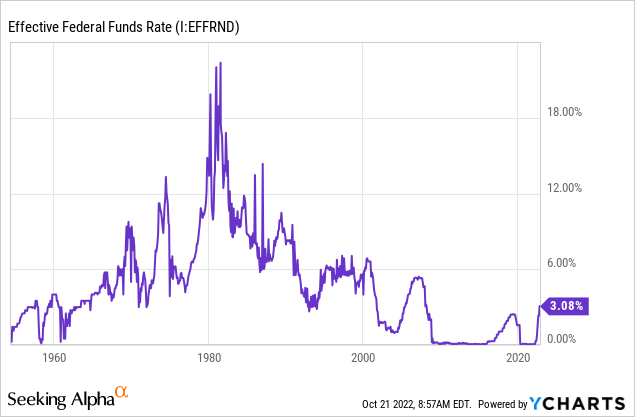

Of course, they were coming out of higher interest rates in the 80s. Presumably, the convertible bonds they held then were still yielding significant rates at that time. So it’s not a perfect comparison, but it can provide a bit more context behind the fund and how it has traded even in decades other than the last decade. Below is a table of effective federal funds rates. I think this just underlines that no time period is really the same.

Y-Charts

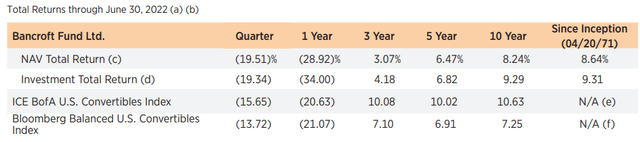

For historical annualized comparisons, the fund has performed well against the benchmarks it has selected. Of course, last year it meant really bad results. In the longer term, the results are comparable. Again, equities have performed well over the past decade to contribute to these results.

BCV annualized returns (Gabelle)

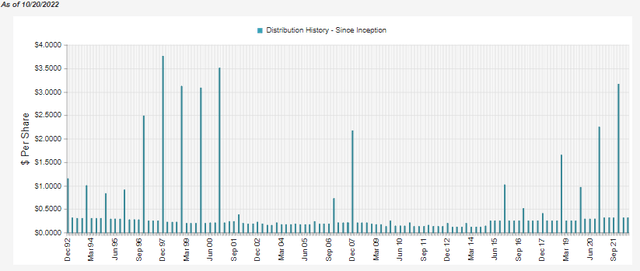

Distribution – 5% minimum policy

One of BCV’s operating methods is this minimum distribution policy. Several of the Gabelli funds operate with this approach. For BCV, this is a minimum 5% policy that it will distribute annually to investors. Sometimes it’s much higher, but it’s the lowest. It is achieved through generally smaller quarterly distributions and then a longer year-end.

BCV distribution history (CEFConnect)

On that date, the share price payout rate was 7.74%, with an NAV rate of 6.66%. Therefore, we have already exceeded this minimum policy at this time. This could mean that unless there is a clear rebound or they make some big gains that they have to pay for, the minimum could already be hit.

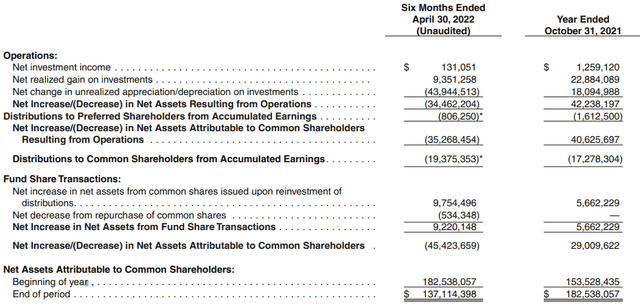

Given that their latest available semi-annual report shows that they have not covered the distribution to shareholders, this suggests that having too many realized gains will not be a problem this year. That being said, this period also reflects the large year-end payment of the previous year.

At $2.85 and approximately 5,517,786 shares outstanding at the end of October 2021, that would represent a significant $15.726 million of the $19.375 million paid out. An adjustment for this big year-end would suggest that the capital gains covered the regular payment.

The low net investment income reflects the low yield of convertible bonds.

BCV half-year report (Gabelle)

All this could suggest that no end of the year could arrive. At the same time, the declines also make the current distribution that would have been considered low before, more attractive.

BCV portfolio

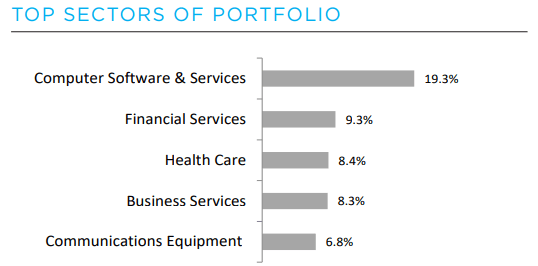

BCV is not only a pure-play convertible fund, but it is strongly oriented towards convertibles. The breakdown in the latest holdings report was: 84.5% convertible corporate bonds, 0.3% convertible preferred stock, 11% convertible mandatory, 2.8% common stock and 1.4% in US government bonds. Overall, the portfolio is more skewed towards technology-focused sectors such as “IT software and services”, which is the largest industry.

BCV sector exposure (Gabelle)

By looking at the top positions, we can better understand the types of holdings they hold, as well as the paltry returns. Ridiculous returns at the moment, as companies could previously sell convertibles on these types of terms. With current interest rates, this is not the case.

BCV Top Ten Holdings (Gabelle)

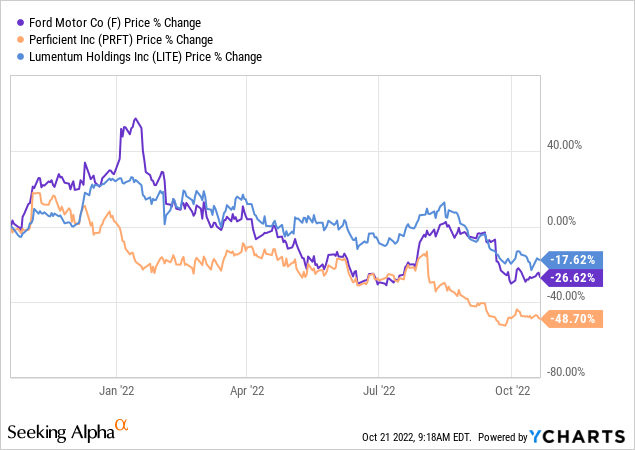

Right in the top ten, we note that the BCV holds a Ford convertible bond (F) with a coupon of 0%. We also have Perficient, Inc. (PRFT) at 0.125% and Lumentum Holdings (LITE) at 0.5%. Most investors are probably pretty sure about Ford’s business; they produce at least two vehicles per year (1.9 million vehicles in 2021, which was a drop due to supply chain issues.)

PRFT is a technology company that provides digital consulting services and solutions. LITE is a technology company that manufactures and sells optical and photonic products worldwide.

Although I am a shareholder of Ford, the share price has obviously not performed well, and this has an impact on the valuation of the underlying convertible held by BCV. Here is the performance of the share price over the last year of these.

Y-Charts

At the end of April 30, 2022, the cost of the bonds was $3,844,711, with a market value of $3,732,750. Unfortunately, the principal amount is only $3.5 million. Since that time, the value of these would have fallen further.

On the other hand, the Perficient cost was $3,643,519 with a market value of $3,238,125 and a principal amount of $3.75 million. The good news here is that this means there is still an advantage if held to maturity at the end of 2026. Unfortunately, there isn’t much of an advantage over the cost of the fund. Given the length of time the fund has held this position, unless the stock goes up again, it could mean that little return has been generated. It is certainly possible, but it seems unlikely in the current context.

While this is an example of a convertible not maturing until 2026, other holdings expire earlier in 2023 and 2024. When these do, they have a good chance of returning that principal. to work in higher yielding instruments, or we could be out of this bear market. It would also help the fund as stock prices appreciate.

Conclusion

Heading into 2022, BCV and other convertible funds found that their portfolios were paring much of the gains they had seen in previous years when convertibles were booming. They were booming because growth was taking off. Now that has reversed and growth is no longer in fashion, with interest rates rising significantly. While that doesn’t mean there’s no more pain ahead, it’s starting to look attractive as holdings drop below face value.

Comments are closed.