Asset class dashboard: December 2021

[ad_1]

SARINYAPINNGAM / iStock via Getty Images

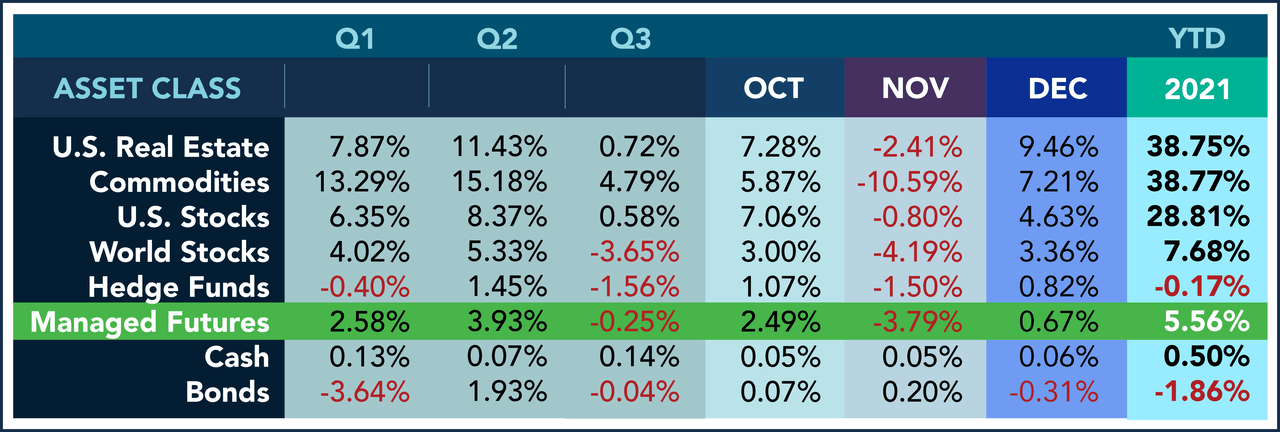

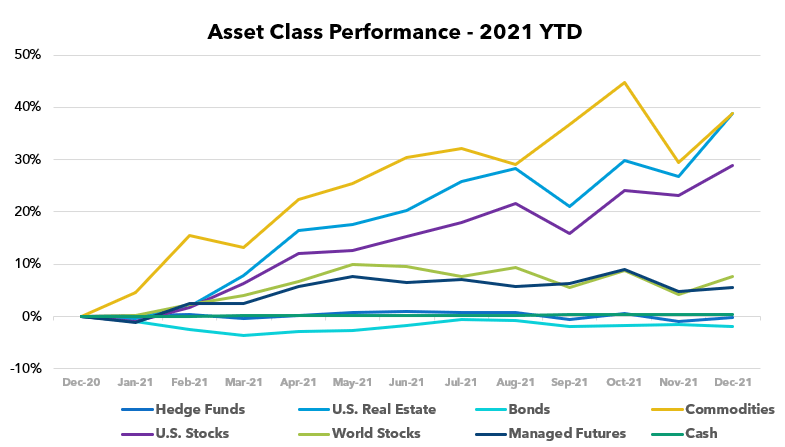

December quickly turned from a red November, offering a rally we hadn’t seen coming and closing 2021 strong. Real estate, commodities and equities were the best performers of the year, where hedge funds and bonds could benefit from some improvement. Our favorite managed futures came through the year, ending the year on a positive note.

We can’t wait to see what 2022 has to offer!

Past performance does not represent future results.

Past performance does not represent future results.

Sources: Managed Futures = SocGen CTA Index, Cash = US T-Bill 13 weeks equivalent annual rate / 12, with YTD the sum of the value of each month, Bonds = Vanguard Total Bond Market ETF (NASDAQ: BND), Hedge Funds = IQ Hedge Multi-Strategy Tracker ETF (NYSEARCA: QAI), Commodities = iShares S&P GSCI Commodity-Indexed Trust ETF (NYSEARCA: GSG), Real Estate = iShares US Real Estate ETF (NYSEARCA: IYR), Global Equities = iShares MSCI ACWI ex-US ETF (NASDAQ: ACWX), US equities = SPDR S&P 500 ETF (NYSEARCA: SPY).

All Y Charts ETF performance data

Warning

The performance data displayed here is compiled from a variety of sources, including BarclayHedge, and reports directly from advisors. These performance figures should not be relied upon in isolation from the individual adviser’s information document, which contains important information regarding the calculation method used, whether or not the performance includes proprietary results, and other footnotes. important to the adviser’s background.

The performance of the benchmark index relates only to the constituents of this index and does not represent the entire universe of possible investments within this asset class. And further, that there may be limitations and biases to indices such as survival, self-report, and instantaneous history.

Managed term accounts may be subject to substantial fees for management and advisory fees. The numbers on this website include all of these fees, but accounts subject to these fees may need to earn substantial trading profits in the future to avoid depletion or depletion of their assets.

Investors interested in investing in a managed futures program (with the exception of programs which are offered exclusively to Qualified Eligible Persons, as that term is defined by CFTC Regulation 4.7) will be required to receive and sign a document. information in accordance with certain CFT rules. the disclosure documents contain a full description of the main risk factors and each fee to be charged to your account by CTA, as well as the composite performance of accounts managed by CTA over at least the past five years. Investors interested in investing in any of the programs on this website are encouraged to carefully read these information materials, including, but not limited to, the performance information, before investing in such programs. .

Investors who are Qualified Eligible Persons as that term is defined by CFTC Regulation 4.7 and interested in investing in a program exempt from the obligation to provide an information document and considered by the regulation to be sufficiently sophisticated to understand the risks and be able to interpret the accuracy and completeness of any performance information on their own.

RCM receives a portion of the commodity brokerage commissions that you pay in connection with your futures trading and / or a portion of the interest income (if any) earned on the assets of an account. The listed manager may also pay RCM a portion of the fees that he receives from the accounts opened to him by RCM.

Original message

Editor’s Note: The bullet points for this article were chosen by the editors of Seeking Alpha.

[ad_2]

Comments are closed.